Why You Need to Leverage AI for Fintech Companies?

Source: PwC

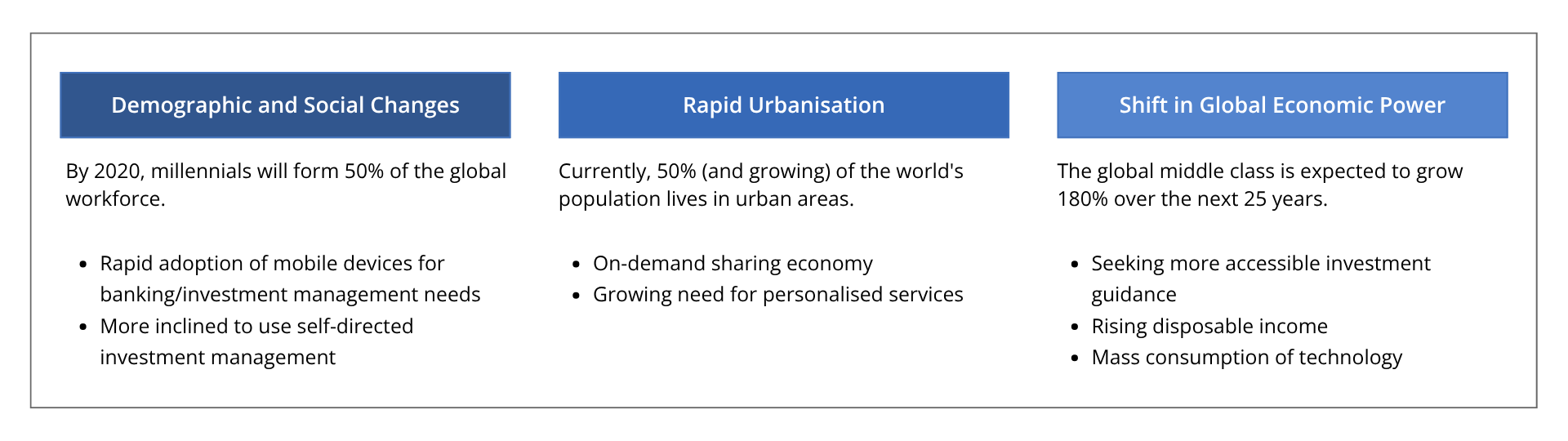

This survey from PwC clearly shows a growing need for technology in the financial services industry. AI for fintech companies and banking services have been revolutionizing how customers make payments and how these fintech companies share data with their vendors for the past few years. This rapid transformation is only set to increase with increased customer demand, faster payment, and an enhanced need from banks and POS providers to access data without violating data security and governance policies.

AI and machine learning (ML) models are core to how modern fintech companies’ function. The payment sector in the fintech firms, AI, is optimizing how transactions are initiated, authorized, and completed. Whether it’s real-time fraud detection, intelligent customer verification, or automating back-end operations, AI in payments enhances security and user experience at every step.

The rise of mobile payment services shows how technology is reshaping consumer expectations. People now demand instant, frictionless transactions. AI helps meet those expectations by making digital payments smarter, faster, and more secure. Through AI in payment processing, companies can monitor transactions in real time, flag anomalies, and even automate customer support, delivering consistent service at scale.

But the impact of artificial intelligence on digital payments goes beyond simply providing convenience. AI empowers fintech companies to streamline internal processes, reduce human error, and deliver more personalized customer interactions. With mobile apps and cloud-based platforms like Snowflake AI Data Cloud, AI-powered systems can analyze massive datasets to extract actionable insights, helping fintech firms cater to both customer needs as well as their vendors and banks.

However, leveraging AI has created many roadblocks for fintech companies. The challenges faced by fintech companies include struggling to integrate AI with legacy systems, ensuring data privacy compliance, and protecting customers from emerging cyber threats. By using Snowflake AI Data Cloud and partnering with Kasmo – a popular global Snowflake consulting company, will help fintech companies overcome these barriers, and they will be able to unlock the full potential of AI.

Challenges Faced by Fintech Companies

Cybersecurity and Data Privacy Risks

Handling massive volumes of sensitive financial data makes fintech companies prime targets for cyberattacks. Cybercriminals are becoming more sophisticated, and a single breach can result in devastating financial and reputational losses. This has made robust encryption, AI-driven fraud detection, and continuous monitoring essential.

Source: PwC

Complex Regulatory Environments

Fintech firms must comply with numerous local and global regulations. Whether it’s KYC (Know Your Customer), AML (Anti-Money Laundering), or data privacy laws like GDPR, regulatory compliance is non-negotiable. Constantly changing legislation requires fintech companies to stay agile and invest in scalable compliance frameworks.

High Competition

As technology and AI continue to boom, there are many fintech companies that are crowding the payments market. They are trying to establish themselves as the leader in payments, especially, how fast and how better services they are able to provide to their customers. This increasing competition has created challenges for fintech companies to continuously innovate and enhance the user experience.

Challenges in Integrating AI with Legacy Systems

Many fintech companies still rely on outdated infrastructure or legacy systems. Integrating advanced AI and machine learning models in fintech with legacy systems can be complex, expensive, and time-consuming. Many payment providers report difficulties aligning new AI models with old data systems and workflows, slowing their digital transformation efforts.

Operational Scalability

Scalability is critical for growth. However, many fintech companies struggle to scale their operations without compromising performance or compliance. As customer bases expand, fintech firms must automate processes, streamline workflows, and implement advanced analytics, to remain efficient.

How AI Helps in Streamlining Payments for Fintech Companies

Leveraging AI for fintech companies is revolutionizing how payments are processed, secured, and optimized. From real-time transactions to fraud prevention, automation, and personalized services :

Real-Time Payments with Enhanced Speed and Security

AI enables real-time payments by dynamically managing network traffic, identifying transaction patterns, and minimizing latency. Machine learning algorithms optimize transaction flows even during peak loads while simultaneously running fraud detection protocols in milliseconds.

Intelligent Fraud Detection and Prevention

One of the best benefits of integrating AI in payments is real-time fraud detection. AI models continuously monitor vast volumes of transaction data to identify anomalies, behavioral shifts, and patterns of financial crime.

Automating Manual Tasks for Maximum Operational Efficiency

AI reduces the burden of repetitive manual work by automating core payment operations like dispute resolution and creating reports and dashboards. Platforms like Snowflake AI Data Cloud make transactions across multiple sources seamless and easy in real time, cutting down processing times and errors. This level of automation not only drives efficiency but also reduces operational costs and frees up human resources for more strategic work.

Driving Hyper-Personalization

With the rise of artificial intelligence and fintech, AI plays a central role in creating personalized experiences. By analyzing transactional and behavioral data, AI empowers fintech firms to create budgeting options and tailor loans according to individual customers. For example, after integrating AI for fintech company “A”, financial managers can now analyze spending patterns and deliver personalized recommendations, building stronger user engagement and loyalty.

Supporting Emerging Payment Methods

AI is at the forefront of innovation in emerging payment types such as digital wallets, cryptocurrencies, etc. In digital wallets, AI offers features like users’ spending insights, fraud prevention strategies, and smart identification of potential threats. AI enhances real-time monitoring, regulatory compliance, and improves scalability, making modern digital payments smarter and more inclusive.

Tackling Regulatory Complexity

Fintech companies must constantly adapt to changing regulations. AI simplifies compliance by automating real-time monitoring, detecting violations, and generating accurate reports. Natural language processing (NLP) tools interpret new regulatory texts and ensure firms adjust policies accordingly. This helps fintech firms stay agile and compliant without compromising innovation.

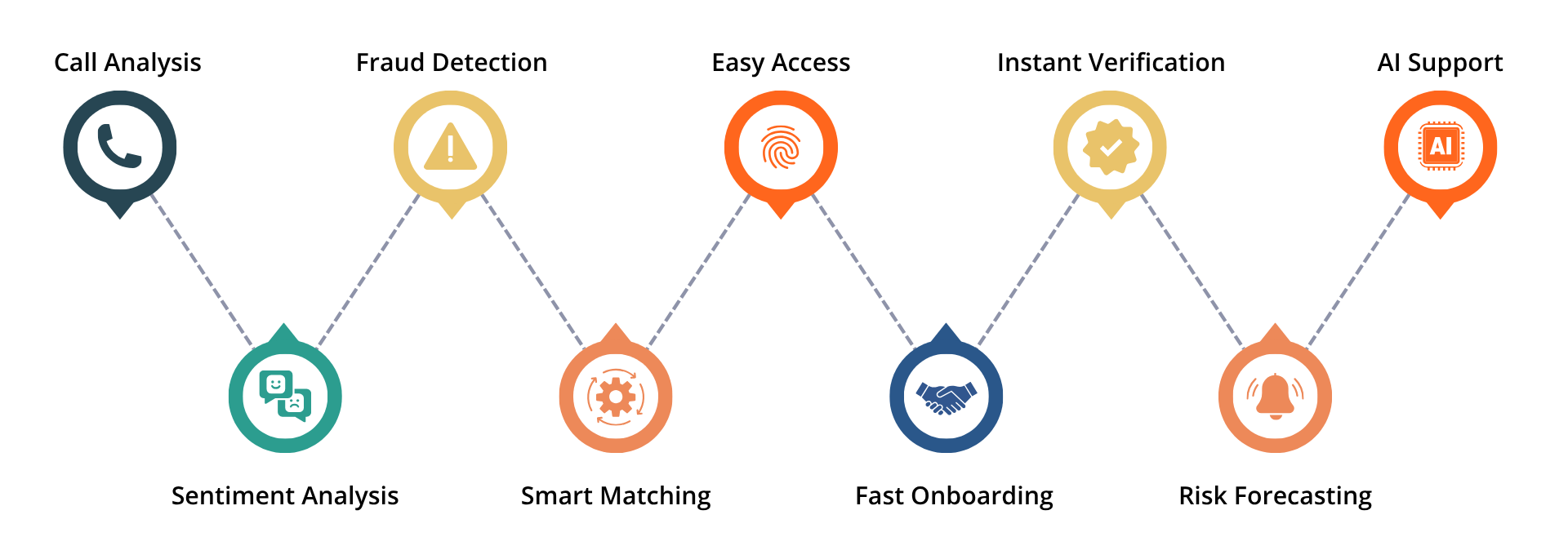

Beyond core payments, AI enhances various other sectors in fintech companies:

What are the Benefits of Leveraging AI for Fintech Companies?

- Automation eliminates manual errors and boosts productivity.

- Accuracy ensures consistency across data and workflows.

- Speed accelerates insights, compliance, and service delivery.

- 24/7 Availability ensures continuous customer engagement

Leveraging AI in payments accelerates a rapid digital transformation in fintech companies. They are better positioned to improve customer satisfaction, reduce fraud, navigate regulations, and remain competitive.

Why Fintech Companies Should Choose Snowflake

As a secure, scalable, and AI-powered platform, Snowflake AI Data Cloud empowers fintech companies to unify fragmented systems, collaborate across departments, and gain real-time insights. Snowflake Financial Services is tailored to solve industry-specific challenges.

Accelerating Reporting with Scalable Architecture

Legacy systems often buckle under the weight of expanding data and user demands. One of our clients, a leading fintech firm, struggled with slow report generation, taking up to five hours to deliver insights due to SQL server limitations. With Kasmo’s migration strategy, the company moved to Snowflake, as it provides separate compute from storage. By integrating Snowflake with Apache Kafka, we helped the firm to process both historical and real-time data streams, enabling near-instant reporting. Kasmo’s expertise helped the client run reports 25x faster, unlocking real-time decision-making capabilities and significantly improving operational agility.

Breaking Down Silos for Seamless Collaboration

Fintech companies often work with vast, scattered datasets across departments and partners. Snowflake solves this problem by allowing secure, live data sharing across teams and external partners, without duplicating data. Whether it’s enhancing customer experiences with 360° insights or streamlining claims operations, Snowflake makes it easy for fintech companies to collaborate with banks and other vendors while maintaining tight data control. This data sharing capability eliminates delays, ensures consistency, and boosts collaboration across multiple cloud environments and locations.

Built-In Governance and Compliance at Scale

Data privacy and regulatory compliance are critical concerns in financial services. Snowflake addresses this with enterprise-grade governance tools, including role-based access control (RBAC), dynamic data masking, and row- and column-level access policies. These features help fintech companies comply with regulations like GDPR, PCI DSS, and local KYC/AML mandates, while also reducing manual overhead. By embedding compliance into the platform, Snowflake reduces the risk of breaches and builds customer trust.

Elastic Scalability

As fintech companies grow, their customer data increases. Snowflake’s elastic scalability enables businesses to expand seamlessly, scaling compute and storage independently to match workload needs without over-provisioning. At Kasmo, we helped the fintech client leverage Snowflake to manage high-concurrency reporting, handle complex analytics, and reduce Total Cost of Ownership (TCO) by eliminating duplicate datasets. With the ability to scale on demand, fintech firms are no longer restricted by infrastructure limitations.

Powering Innovation Through AI & Advanced Analytics

Snowflake doesn’t just store data; it helps fintech firms utilize the full potential of their data. Its compatibility with leading AI and ML tools makes it easy for these companies to enhance fraud detection strategies, risk modeling, predictive analytics, customer sentiment analysis, and real-time personalization. With all data centralized, clean, and readily accessible, teams can accelerate development cycles and deliver smarter, faster insights.

Why Choose Kasmo

If you want a successful Snowflake partner with Kasmo today. As a Premier Snowflake Partner, Kasmo brings deep technical knowledge, industry-specific expertise, and a digital-first approach to help you migrate completely to Snowflake. Our experts help you extract data from legacy systems and design migration journeys tailored specifically for your business needs. We also provide post-implementation support and deliver end-to-end services that reduce complexity and ensure long-term ROI.

Conclusion

Leveraging AI for fintech companies can help them streamline digital payments and detect fraud in real time. Additionally, integrating AI in payments also helps fintech companies provide hyper-personalized services to customers. As fintech companies navigate intense market competition, complex compliance policies, and rising customer expectations, AI and machine learning offer a clear path toward smarter operations, stronger security, and enhanced customer experiences.

Platforms like Snowflake are rapidly transforming the future of fintech companies. Providing a scalable, secure, and AI-ready architecture, Snowflake empowers fintech companies to unlock real-time insights, eliminate data silos, and build agility and growth. Snowflake consulting partners like Kasmo help fintech companies overcome challenges with legacy systems and embrace a cloud-native future.

By combining artificial intelligence and machine learning models, fintech companies are shaping the next chapter of financial services. Fintech firms that invest in AI-driven platforms and advanced data strategies today will lead the charge in delivering faster, smarter, and more resilient financial solutions for tomorrow.