Enterprise data architecture and data analytics have evolved rapidly over the past two decades. In the early 2000s, banks faced challenges in managing siloed databases, leading to the rise of centralized data warehouses. Later, the increase in data volume and data variety drove innovation like cloud computing.

Cloud data platforms integrated with AI and ML have redefined data strategy by shifting the focus to smarter and more seamless data migration strategy, analytics and visualization, enabling accurate insights and intelligent automations in BFSI.

Enterprises are now modernizing their data strategy and architecture. Legacy infrastructure in Finance and Banking firms no longer supports management of high data volumes and AI scalability requirements that come with rising customer expectations. A well-designed data strategy, paired with robust data governance, has become crucial in streamlining operations, reducing costs, and driving innovation.

The Value of Data Architecture for Businesses

Data architecture is the structural foundation that governs how data is collected, stored, integrated, and used across your banking firm. For financial organizations that handle massive and complex data daily, it plays a pivotal role in enabling seamless data sharing and ensuring compliance with global regulations.

94% of data leaders cite the lack of a defined data architecture as one of their top challenges. A poorly designed architecture leads to inefficiencies such as fragmented systems, duplicated data, and delayed decision-making. On the other hand, a modern architecture meets evolving business needs by enabling multiple functions like advanced analytics, real-time fraud detection and personalized customer experiences in banking.  Source: IBM

Source: IBM

Technology like IoT is generating new streams of data, and the ability to integrate this information effectively is critical to running smooth operations. The right platform for your data management ensures that data is unified, access is granted to relevant teams for collaboration and is perfectly aligned with your data migration strategy.

How Data Governance Enhances Data Management

Having a modern data architecture alone doesn’t guarantee data usability, trustworthiness, or compliance. Data governance ensures that the data flowing through your architecture is properly managed, secured, and aligned with business and regulatory requirements. A data governance framework outlines how your finance organization manages critical data assets, by specifying ownership, responsibilities, and protocols to ensure security and data privacy.

Implementing a strong data governance framework can offer a wide variety of benefits for finance organizations:

Extract Value from Data

With clearly defined data ownership, usage policies, and quality standards, financial institutions can fully leverage data assets. Governance ensures that data is accurate, consistent, and accessible, so teams can extract actionable insights more effectively and confidently.

Promote Innovation and Efficiency

Data governance minimizes time spent searching for data, fixing data inconsistencies, or dealing with poor-quality datasets. This operational efficiency frees up resources for innovation, allowing teams to focus on solving complex business problems rather than data wrangling.

Provide a Single Source of Truth

Data governance helps standardize processes and align metrics across departments. This creates a unified data foundation where everyone in the bank works with updated, reliable data.

Help Ensure Data Privacy

With privacy regulations becoming stricter, governance frameworks provide a structured approach to meeting these mandates. They define access controls, data handling procedures, and audit trails to ensure sensitive data is protected and regulatory obligations are met.

Encourage AI Initiatives

AI and machine learning rely on clean, labeled, and trustworthy data. Governance helps curate high-quality training data while ensuring the ethical use of data and compliance with AI-related standards. This reduces the risk of biased, faulty, or non-compliant models.

Enable Accurate Data Analytics

Inaccurate or inconsistent data weakens analytics and decision-making. A governance framework reinforces data quality, helping banks and financial institutions trace insights back to their sources, verify accuracy, and make better-informed decisions.

Modernizing Legacy Systems: Key Challenges

Most financial firms are struggling to grow and scale their business due to legacy systems and outdated data infrastructure. Common challenges include:

Complex Architecture

Many banks rely on legacy systems integrated with newer applications over time. This creates a patchwork of technologies that don’t work well together, making upgrades slower and impacting innovation while also raising maintenance costs.

Fragmented Data Warehouses

Financial institutions often operate with multiple data warehouses, some within the company database and others in the cloud, without proper integration. This fragmentation leads to data silos, duplicate records, and inconsistent reporting, making it difficult to get a unified view of customers, transactions, and risk exposure.

Ineffective Tool Usage

Even after implementing new data platforms, many financial institutions fail to utilize them to their full potential. These issues lead to delayed insights, higher costs, and increased compliance risks. They also limit the ability to scale AI in operations.

Data Architecture as a Strategic Enabler of AI

AI is a key driver of competitive differentiation across finance institutions. AI has a variety of use cases, from predictive maintenance to customer personalization. But operationalizing AI at scale requires a modern enterprise data architecture.  Generative AI models require high-quality, contextual data to produce reliable outputs. If the data inputs are flawed or incomplete, AI predictions can become biased or even dangerous. Scalable data architectures that are governed and secure are crucial in ensuring that your AI integration is successful.

Generative AI models require high-quality, contextual data to produce reliable outputs. If the data inputs are flawed or incomplete, AI predictions can become biased or even dangerous. Scalable data architectures that are governed and secure are crucial in ensuring that your AI integration is successful.

Building a Resilient Data Foundation

To truly benefit from enhancing data strategy, your financial firm needs to adopt a comprehensive framework that combines data architecture, data governance, and the cloud platform. Here are key steps to get started:

Assess Your Current State

Begin by conducting a thorough evaluation of your existing data landscape, from the systems and tools in use to the governance policies that guide data usage. This helps uncover gaps in integration, performance bottlenecks, and risks in security or compliance. Without a clear understanding of the current environment, it’s difficult to chart a realistic path toward improvement.

Define a Vision

A resilient data foundation requires a vision that aligns with your business objectives and long-term AI goals. This vision should outline how data will be used to create value, drive decision-making, and enhance customer experiences. It must also account for emerging trends and regulatory requirements to ensure that the data strategy remains relevant over time.

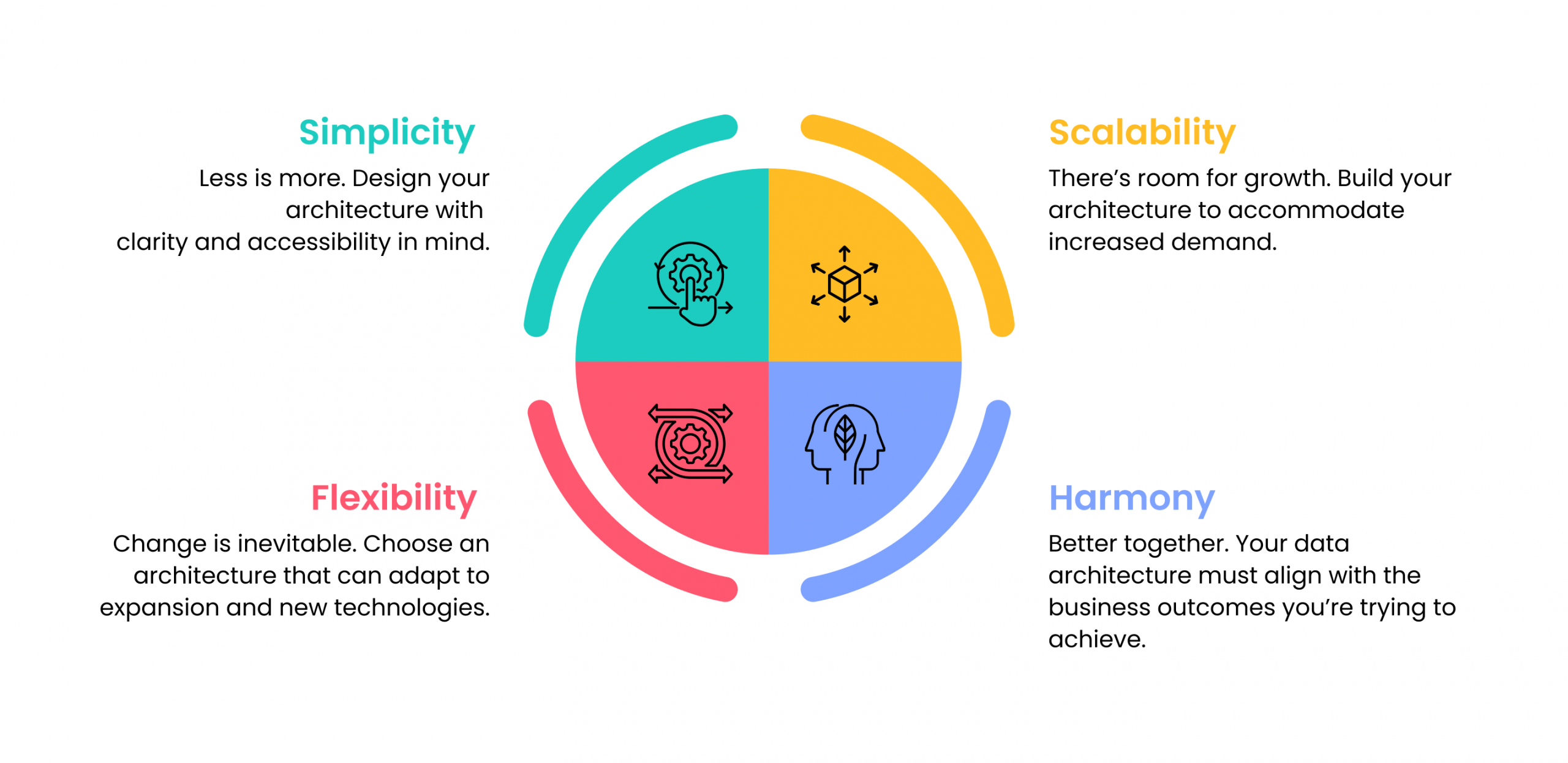

Choose the Right Data Archetype

Not all financial organizations need the same data architecture. Selecting the right archetype means striking a balance between cost, complexity, and performance. Factors like the volume of data, the speed at which it needs to be processed, and the level of analytical sophistication required – all play into determining the most suitable model for your operations.

Prioritize Data Quality

A well-structured data architecture is only as good as the quality of the data it holds. This is why robust governance practices that cover validation, cleansing, and compliance must be embedded into daily operations. By ensuring that data is accurate, timely, and trustworthy, financial organizations can avoid errors and make more confident business decisions.

Leverage Cloud Capabilities

Snowflake, a leading cloud platform, unlocks the scalability and flexibility needed to keep pace with dynamic market demands. It enables financial organizations to store and process vast amounts of data cost-effectively while facilitating quick experimentation and continuous innovation. The cloud also supports seamless integration of AI and advanced analytics, turning data into actionable insights faster.

Enable Collaboration

The value of a resilient data foundation multiplies when teams across your financial organization can collaborate effectively. Encouraging data engineers, business leaders, compliance officers, and analysts to work together fosters shared ownership of data initiatives. This collaborative culture helps break down departmental silos, ensures data is interpreted consistently, and accelerates innovation.

Better Data Management with Snowflake

Organizing and maintaining high-quality, secure, and accessible data is a major challenge for many financial organizations. Even advanced integrations and AI will generate biased results in the absence of trusted and reliable data. This is the reason why establishing a well-designed data migration strategy is crucial.

You can optimize your data strategy without compromising on your business goals, with Snowflake. Snowflake simplifies the way banks design data strategies and manage their data. Snowflake’s Data Cloud enables your financial firm to seamlessly combine transactional and analytical data, strengthen data governance, and enhance security through improved threat detection.

Kasmo brings a unique combination of Snowflake implementation expertise and domain-specific understanding of the banking and financial services sector. Our team ensures that your Snowflake solution is tailored for security, scalability, and compliance, while optimizing performance for advanced analytics and AI workloads.

With a focus on seamless implementation and measurable business outcomes, Kasmo empowers your BFSI organization to unlock the full potential of Snowflake and transform data management.

Here are some key benefits of leveraging Snowflake’s Data Cloud:

Unify data

Most financial institutions must maintain two separate databases: one to handle transactional workloads and another for analytical workloads. Snowflake consolidates both into a single database so that users get a highly simplified architecture with less data movement and consistent security and governance controls.

Structured Documents

Businesses deal with various kinds of documents daily, like invoices, receipts and forms. But extracting information from them is often slow, manual, and error-prone. Snowflake helps to transform these unstructured documents into structured data automatically. It uses AI to read and analyze documents, so that your teams can quickly access the information they require without technical know-how or coding skills.

Increase Data Visibility and Security

Snowflake offers built-in capabilities for advanced features in compliance, privacy, security, and data discovery. This helps safeguard your accounts, users, and data assets while enabling better control and inter-departmental collaboration. Snowflake ensures customers themselves are well-equipped to identify risks and respond to potential threats swiftly and effectively.

Improve Data Governance

Snowflake makes it easier to track and manage sensitive data. It enables teams to apply rules and labels to protect important data across the system. For machine learning use cases like fraud detection, demand forecasting and customer segmentation, it allows teams to track the data flow from start to finish. This makes it easier to ensure compliance, improve transparency, and produce better results.

Conclusion: From Data to Differentiation

In BFSI, modernizing data architecture is critical. The right framework allows financial institutions to extract more value from data, comply with evolving regulations, reduce operational costs, and scale AI in operations and processes.

A modern, governed, and cloud-enabled data architecture transforms raw data into a strategic asset. It empowers banks to make faster, smarter decisions and deliver seamless, personalized experiences to customers globally. As data continues to grow in volume and complexity, those who invest in robust enterprise data architecture will be in a position to lead this industry.