Introduction

In an always-on digital economy, customer service in banking must balance speed, personalization, and security. When banks rely on fragmented systems and manual service workflows, service agents search across multiple screens while customers repeat the same information across channels. These gaps slow down resolution, increase operational costs, and erode trust at the very point where it matters most.

As customer expectations shift toward instant, personalized, and always-on service, traditional customer service models are reaching a breaking point. So, it is essential to adopt intelligent, predictive engagement banking services. According to a Deloitte survey, 86% of financial services AI adopters say AI will be very or critically important to their business success in the next two years.

Salesforce Financial Services Cloud provides a unified customer foundation and AI-powered capabilities for banks. Integrating real-time customer context, automation, and agentic intelligence helps banks enhance customer service, satisfaction, and trust. In this blog, we explore the challenges of traditional customer service models, why AI has become essential in modern banking, and how Salesforce enables banks to deliver faster and personalized customer service.

Challenges in Traditional Customer Service Models

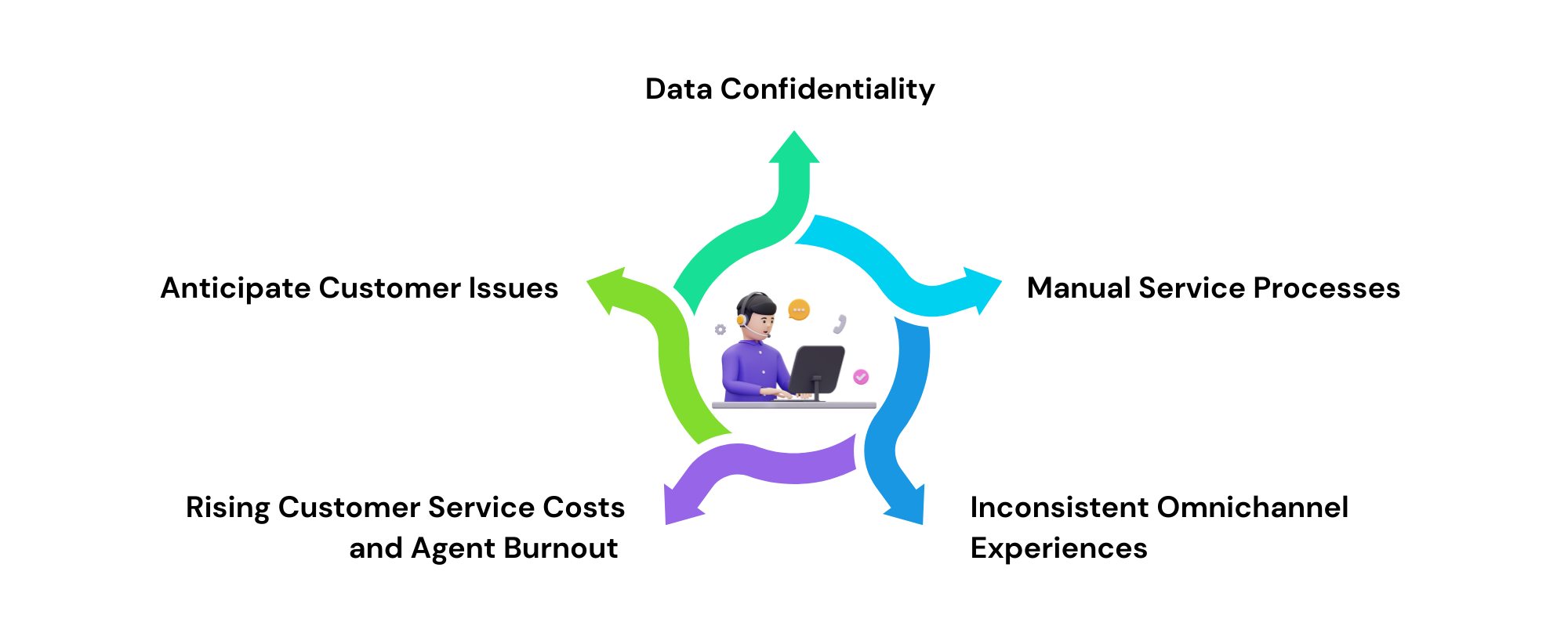

Data Confidentiality

Customer service in banking involves constant access to highly sensitive information, including account details, transaction history, and financial records. Traditional customer service models often rely on multiple legacy systems and manual processes, increasing the risk of unauthorized access or data exposure. Also, a lack of a unified profile hinders personalized customer service or understanding customer intent in real time

Manual Service Processes

Most traditional banking services depend on manual processes and respond after a customer raises an issue. Agents depend on manual workflows, static scripts, and predefined rules, which slow down response times. Simple requests like balance inquiries or card issues consume more time, reducing capacity for complex, high-value interactions. This manual approach limits scalability and increases customer service costs.

Inconsistent Omnichannel Experiences

Customers today interact with banks through branches, mobile apps, websites, chat, and call centers. Traditional service models struggle to provide consistency across these channels. Information shared in one channel is often not visible in another, resulting in disjointed experiences. This inconsistency erodes customer trust and loyalty.

Anticipate Customer Issues

Without advanced analytics or real-time intelligence, traditional customer service models cannot anticipate problems before they escalate. Banks often discover service issues like failed transactions or account access problems after customers complain. This reactive method increases churn risk and affects customer satisfaction. Predicting intent, sentiment, or potential dissatisfaction remains difficult with legacy tools.

Rising Customer Service Costs and Agent Burnout

As customer expectations rise, service volumes increase, placing additional pressure on contact centers. Agents are expected to resolve issues quickly while navigating multiple systems, leading to fatigue and burnout. High turnover and training costs further strain operations. Banks using traditional models fail to balance cost-efficiency with high-quality customer service.

The Need for AI in Modern Banking Customer Service

As customer expectation rises, AI has become a foundational capability for customer service in banking. Consumers look for instant, accurate answers and guidance that reflect their financial context. AI enables banks to deliver always-on service that understands customer intent, interprets transactional context, and responds with precision. By embedding intelligence, banks can scale personalized support without increasing operational overhead.

More importantly, AI allows customer service to evolve and analyze customer data. AI systems can understand conversations, surface insights, recommend relevant products, and proactively guide customers through financial decisions. This transforms customer service into a strategic touchpoint that strengthens relationships, improves retention, and increases lifetime value.

How AI Is Reshaping Customer Service in Banking

AI-Powered Virtual Assistants

AI-driven chatbots and virtual assistants enable banks to provide 24/7 customer support across channels, including mobile apps, websites, and messaging platforms. These assistants handle high-volume, routine queries like balance checks, transactions, and card-related issues instantly. This reduces wait times for customers and frees service reps to focus on high-value interactions that require empathy and judgment.

Personalized Service Experiences

By analyzing customer profiles, transaction history, and past interactions, AI enables highly personalized service experiences. Agents can gain relevant context and recommendations during live interactions, allowing them to resolve issues faster. For customers, this means less repetition, more relevant responses, and improved trust.

Customer Churn Prevention

AI enables banks to provide proactive service by identifying patterns that signal dissatisfaction or potential churn. For example, repeated failed transactions or frequent service complaints can trigger immediate outreach before the customer decides to leave. This early intervention helps banks resolve issues faster and strengthen customer trust.

Improves Productivity and Reduces Operational Costs

AI acts as a digital assistant for service agents by summarizing cases, suggesting next-best actions, and automating post-interaction tasks. This reduces handling time and agent fatigue while improving consistency and service quality. For banks, this translates into lower operational costs and a more resilient customer service model.

Salesforce Financial Services Cloud: Building a Unified Service Foundation

Financial Services Cloud is a CRM platform designed to give banks a single, unified view of every customer across products, channels, and lines of business. Instead of relying on fragmented systems where customer profiles are stored separately for deposits, loans, cards, and support, Financial Services Cloud consolidates all relevant information into a customer 360 profile. This unified foundation reduces inefficiencies in verifying identities across systems or reconciling duplicate records, enabling service reps to resolve customer issues quickly.

The Cloud also embeds industry-specific tools and workflows that support the unique compliance and operational requirements of banking. Features like self-service portals and service process automation allow banks to streamline common customer interactions while maintaining regulatory integrity. Integrated analytics and insights help service and relationship teams to offer personalized guidance around goals like saving or investment planning.

The platform further extends its value by incorporating AI and automation capabilities that enhance operational intelligence. Predictive insights and generative AI tools help banks anticipate customer needs and automate routine tasks. As a result, Financial Services Cloud transforms how banks deliver personalized, compliant, and better service across digital and human touchpoints.

How Financial Services Cloud Enables AI Powered Customer Service

Unified Customer 360

Financial Services Cloud enables an AI-powered service by first unifying customer data across accounts, transactions, relationships, service history, and interactions into a single Customer 360 view. This consolidated data foundation allows AI models to understand customer context. This eliminates silos, and AI can analyze the full financial relationship and support faster, more accurate issue resolution and personalized customer service.

Intelligent Case Routing and Service Automation

AI embedded within Financial Services Cloud automates routine service operations like case classification, prioritization, and routing. Using historical service data and intent detection, the platform directs requests to the right team or channel without manual intervention. Automation reduces handling time for high-volume banking requests like balance inquiries, address updates, or dispute tracking. This allows service teams to focus on complex, high-value customer interactions.

AI-Driven Self-Service and Digital Assistance

Self-service experience is a critical component of AI powered customer service in banking. According to Salesforce research, 81% of customers attempt self-service before seeking support. Services Cloud supports intelligent self-service through AI-enabled chatbots, knowledge recommendations, and guided workflows. Customers can resolve common queries, like transaction status, account details, or service requests. AI ensures contextual, accurate, and consistent responses that reduce frustration and help in customer churn prevention.

Agentforce-Enabled Agentic Service Execution

Agentforce extends Financial Services Cloud by enabling agentic AI solutions across service workflows. Instead of only surfacing insights, Agentforce automates complex service processes like initiating service processes, escalating exceptions, triggering follow-ups, or recommending next-best actions. With built-in governance, approvals, and audit trails, banks can safely scale autonomous service execution while keeping humans in control of high-impact decisions.

Conclusion

AI powered customer service has become a critical differentiator for banks to meet customer expectations. By eliminating manual processes and fragmented systems, banks can deliver faster resolutions, consistent omnichannel experiences, and improve customer experience. With Salesforce Financial Services Cloud and agentic capabilities like Agentforce, banks gain a unified customer foundation where intelligence, automation, and human expertise work together.

Kasmo, with deep expertise in Salesforce Financial Cloud and AI-led services, helps banks adopt this shift. From designing unified Customer 360 models to implementing intelligent service automation and agentic workflows, Kasmo supports banks at every stage of the journey. By aligning technology with business goals, regulatory requirements, and service operations, our team enables banks with AI-driven customer service.