Introduction

Retail pricing no longer changes at the end of the season; it changes by the minute. Imagine an online shopper hesitating over a product, while another nearby store is about to run out of the same item. In that moment, a fixed price becomes a missed opportunity. Modern retailers are operating in an environment where demand fluctuates rapidly, competition is always visible, and customers expect prices to reflect real-time value. So, static pricing models are not effective.

This is where adopting dynamic pricing works. By continuously adjusting prices based on factors like demand, inventory, competitor pricing, customer behavior, and market conditions, retailers can improve margins. From flash sales and surge pricing to personalized offers and regional price optimization, dynamic pricing has become a core capability for retailers aiming to balance profitability with customer experience.

In this blog, we explore what retail dynamic pricing is, how it differs from elastic pricing, the key components and pricing strategies, best practices for implementation, and how Salesforce enables retailers to adopt dynamic pricing.

What is Retail Dynamic Pricing?

Retail dynamic pricing is a strategy where product prices are adjusted in real time based on changing market conditions, customer demand, inventory positions, competitive pricing, and contextual signals across channels. Traditional pricing models consider periodic price updates, but dynamic pricing in retail adopts changes. Prices vary daily, hourly, or even instantly across e-commerce platforms, mobile apps, and in-store digital shelves. The objective is to optimize revenue, margin, and inventory turnover while maintaining brand and customer trust.

In a modern retail environment, dynamic pricing is not limited to discounting. It includes price increases during high demand, controlled markdowns for slow-moving stock, location-specific pricing, and personalized price adjustments. Successful dynamic pricing systems balance automation with governance to ensure fairness, compliance, and consistency across channels.

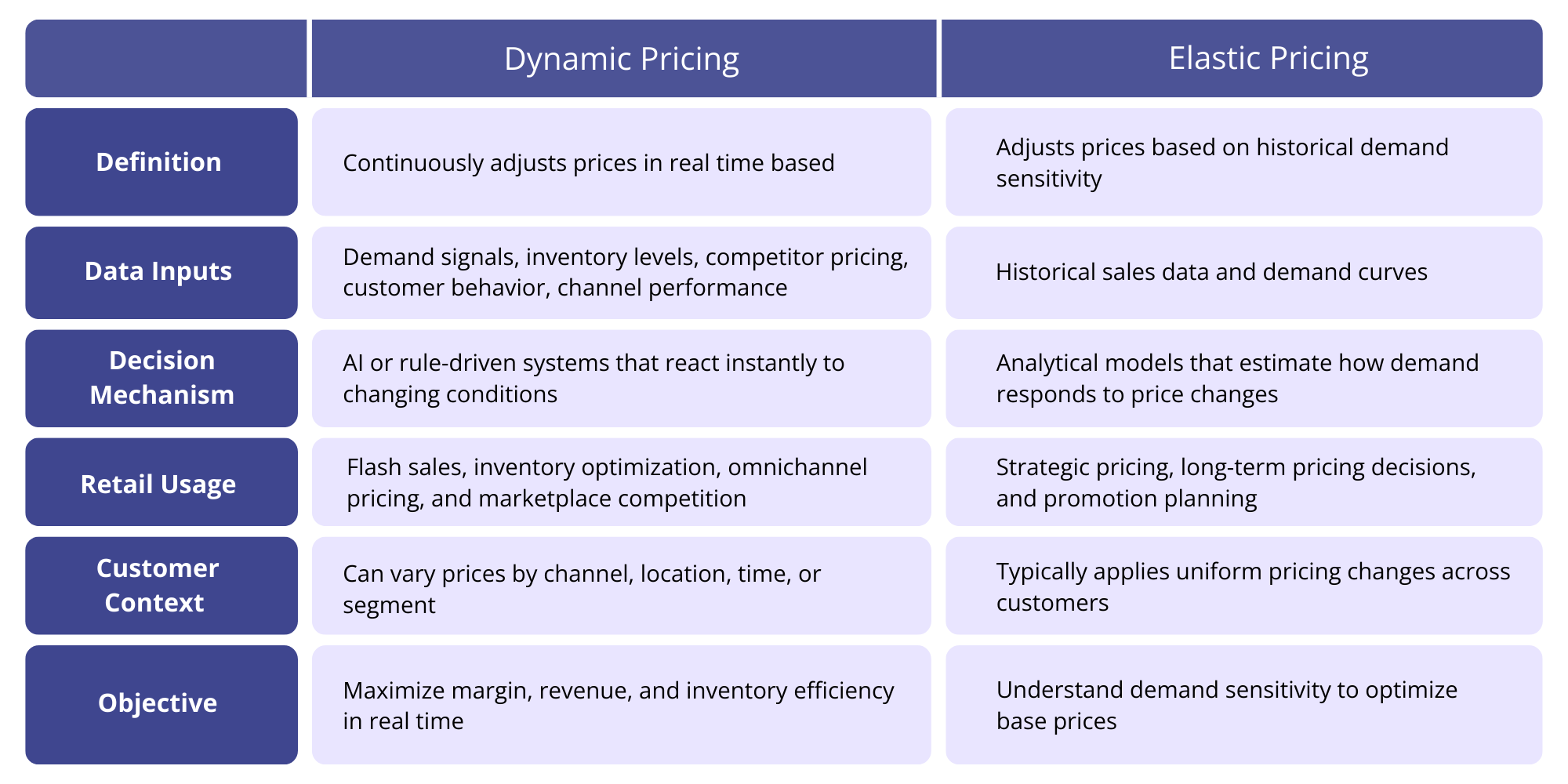

Dynamic Pricing vs. Elastic Pricing

Core Components of a Dynamic Pricing Strategy

Retail dynamic pricing is driven by a tightly integrated intelligence loop that connects data, prediction, and execution. The core components include-

Retail Data Foundation

A dynamic pricing strategy begins with a robust retail data foundation that continuously captures and contextualizes signals. Retailers must aggregate data from point-of-sale systems, e-commerce platforms, inventory systems, promotions engines, and customer interaction channels.

Beyond raw data collection, the emphasis is on contextual analysis. This includes understanding sell-through rates by SKU, location, and demand fluctuations by channel, and customer responsiveness to previous price changes. The goal is to ensure pricing engines in real-time, trusted view of demand, supply, and competitive dynamics to inform every pricing decision.

Demand Forecasting

Predictive analytics enables retailers to anticipate pricing. Advanced forecasting models analyze historical sales, promotion performance, demand elasticity, and customer behavior to estimate how different price points will influence volume, margin, and inventory movement. Predictive pricing models also evaluate cross-product effects, for example, substitution risk when similar products are priced differently.

Rather than producing static recommendations, these models continuously learn from outcomes by adjusting predictions based on actual sales performance and customer data. This allows retailers to proactively optimize prices before demand shifts or inventory imbalances occur.

Autonomous Price Execution

This component includes the ability to execute price changes autonomously and consistently across retail touchpoints. Dynamic pricing systems translate predictive insights into real-time price actions across digital commerce, marketplaces, and in-store channels.

Prices are adjusted based on live demand signals, inventory thresholds, competitive movements, and business guardrails like margin floors and brand policies. For example, prices may increase automatically during high demand to protect margins or decrease selectively to accelerate clearance of slow-moving stock.

Common Dynamic Pricing Models Used in Retail

Retailers apply different dynamic pricing models depending on demand volatility, strategy, data, and business goals. The following models are the most widely adopted across retail.

Demand Based Pricing

Demand-based pricing adjusts prices according to forecasted customer demand. When demand increases, prices rise to protect margins; when demand weakens, prices are lowered to stimulate sales. In retail, this model is commonly used for seasonal products, limited-availability items, and fast-moving SKUs. For example, prices may increase during peak shopping periods or decrease when customer interest drops. The model relies on continuous monitoring of sales velocity, traffic, and conversion rates to determine optimal price points.

Inventory-Driven Pricing

Inventory-driven pricing adjusts prices based on stock levels, sell-through rates, and inventory aging. When inventory is overstocked, prices are reduced to accelerate movement. When inventory is scarce, prices may increase to balance demand and availability. Retailers use this model to minimize markdown losses, reduce carrying costs, and improve inventory turnover. It is especially effective in categories like fashion, electronics, and perishable goods.

Competitive Pricing

Competitive pricing continuously monitors competitor prices and adjusts to maintain market positioning. Prices may be matched, undercut, or strategically positioned above competitors based on brand strength and value proposition. This model is widely used in price-sensitive retail segments. Retailers often define rules like minimum margin thresholds or selective price matching to avoid destructive price wars.

Time-Based Pricing

Time-based pricing changes prices based on timing factors such as time of day, day of week, seasonality, or product lifecycle stage. Prices may decrease as products approach end-of-season or increase during high-traffic shopping windows. Using it helps to align pricing with buying behavior and product relevance. For example, early-season pricing may prioritize margin, while late-season pricing focuses on inventory clearance.

Customer-Segment Pricing

Customer-segment pricing adjusts prices or offers based on customer attributes like loyalty status, purchase history, or channel engagement. Rather than changing list prices, retailers often use personalized discounts or targeted offers. This model increases customer lifetime value while maintaining overall price integrity. It is typically powered by customer data platforms and personalization engines to ensure relevant and compliant pricing actions.

Best Practices for Implementing Dynamic Pricing Successfully

Implementing dynamic pricing in retail is a strategic approach that blends data, technology, governance, and customer experience. The following best practices help retailers deploy dynamic pricing in a controlled, scalable, and profitable way.

Align with Business Strategy

Dynamic pricing should directly support broader business objectives. Retailers must clearly define what success looks like, whether it’s increasing sell-through of slow-moving inventory, maximizing margin, or improving price competitiveness in key categories. This alignment ensures pricing decisions are intentional rather than reactive.

Segment Products and Customers

Not all products or customer segments should follow the same pricing logic. Retailers should classify SKUs based on demand elasticity, margin structure, and seasonality. Similarly, customer segmentation allows personalized pricing. Strategic segmentation ensures that retail dynamic pricing is applied where it adds value and minimizes risk.

Define Pricing Guardrails

To maintain stability and brand integrity, retailers must establish pricing guardrails. These include minimum and maximum price thresholds, margin floors, discount limits, and frequency controls for price changes. This prevents extreme price swings, protects profitability, and ensures compliance.

Start Small with Controlled Pilots

Before rolling out dynamic pricing across the entire assortment, retailers should begin with pilot programs. Select specific categories, channels, or regions to test pricing logic. Pilots provide real-world insights into customer response, operational readiness, and revenue impact. This phased approach reduces risk and enables data-driven refinement before scaling.

Omnichannel Pricing Consistency

Customers expect consistent pricing across online, mobile, and in-store experiences. Dynamic pricing strategies must be synchronized across all channels to avoid confusion and loss of trust. Retailers should integrate pricing engines with POS systems, e-commerce platforms, and mobile apps to ensure near real-time updates.

How Salesforce Helps Enable Dynamic Pricing in Retail

Salesforce enables retail dynamic pricing by unifying real-time customers, products, and operational data into a single intelligence layer. With Salesforce Data Cloud, retailers can ingest and harmonize data from POS systems, e-commerce platforms, inventory systems, loyalty programs, and more. This creates a unified view of inventory availability, customer behavior, and channel performance. When combined with Einstein AI, retailers can analyze historical trends and buying patterns to predict optimal pricing and customer segments.

Dynamic pricing execution is operationalized through Salesforce Commerce Cloud and Order Management, where AI-driven price recommendations can be applied consistently across digital and physical channels. Retailers can define pricing rules, margin guardrails, and promotional constraints using Salesforce Flow and business logic, ensuring automated price adjustments. Integration with Marketing Cloud enables retailers to activate personalized pricing and offers across channels.

Conclusion

The most successful retailers don’t react to the market; they anticipate it. Retail dynamic pricing provides the ability to respond to market volatility, ensuring every price reflects demand, availability, and customer context. When done right, it becomes a competitive advantage that drives both profitability and trust.

Kasmo supports this shift by helping retailers implement dynamic pricing solutions on Salesforce. From data integration to AI-driven price logic and automated execution, Kasmo ensures pricing intelligence flows seamlessly into day-to-day retail operations.