Introduction

As digital transformation continues to reshape the BFSI (Banking and Financial Services) industry, financial services firms must manage risk effectively. Financial services organizations need AI in risk management to protect sensitive data, protect the firm against cyber threats and adhere to existing regulatory and compliance policies set up by global regulatory bodies.

With the increasing volume and variety of financial data, traditional risk management models struggle to keep up. With AI and machine learning (ML) models, financial services firms are capable of processing massive datasets in near real-time, identifying customer and market patterns, and strategizing more accurate, proactive, and scalable risk management policies.

This blog explores why financial services firms need AI in risk management, how it is transforming compliance, credit risk, cyber risk, and fraud detection and how firms can leverage Snowflake – the popular AI Data Cloud platform to create robust risk management strategies.

Why Financial Institutions Need AI in Risk Management

Financial services firms who are still using on-premise and legacy systems are facing challenges to consolidate, analyze and store data. With increasing volumes of data, legacy systems are unable to store and maintain data integrity and analyze the huge datasets to uncover patterns that can protect the financial services firms against cybercrimes and loss of sensitive information. By leveraging AI and machine learning, financial services firms can eliminate redundancies in legacy architecture, protect sensitive data and eliminate data silos.

- Process massive datasets with both structured and unstructured data in real time.

- Predict outcomes and trends based on historical data patterns.

- Automate time-intensive tasks, freeing up human experts for high-value strategic work.

- Enhance compliance by continuously monitoring regulatory changes.

By adopting AI, financial services firms can build dynamic and proactive risk management systems—those which learn and evolve as cybersecurity threats become more sophisticated.

Key Applications of AI in Risk Management

Here’s how financial services firms can use AI in financial risk management:

Regulatory Compliance and Governance

Financial services firms must adhere to an array of regulatory policies, many of which are frequently updated. It can be very difficult for these firms to remember and adhere to every single regulatory policy. Moreover, violating any single regulatory or compliance policy can result in fines, legal liabilities, or reputational damage.

Implementing AI in risk and compliance simplifies this process. AI or AI-powered tools can parse lengthy regulatory documents, summarizing key requirements, comparing policies, and even automatically answering compliance-related queries.

- Policy Comparison: AI scans and compares regulations across regions and identifies inconsistencies or conflicts in internal compliance documentation.

- Automated Monitoring: AI tools continuously monitor changes in regulatory requirements and trigger alerts for updates.

- Code Auditing: AI can review application or system code to identify compliance issues, especially concerning data privacy laws like GDPR.

- Smart Auditing: AI systems can pre-screen audits by flagging anomalies, helping financial services firms to re-check audits.

Financial Crime and Fraud Detection

Financial crimes like money laundering, credit card fraud and other financial frauds cost billions to organizations annually. As our world continues to experience a technological boom, financial frauds become more sophisticated and difficult to tackle.

However, implementing AI in financial risk management brings a transformative shift by enabling predictive, real-time fraud detection and prevention. By identifying behavioral anomalies and suspicious patterns, AI drastically reduces false positives and improves the accuracy of fraud detection.

Key Benefits

- Real-time Monitoring: AI analyzes transaction data on the fly and flags suspicious activities within seconds.

- Behavioral Profiling: ML models can be trained to predict customer behavior to detect anomalies like account takeovers or money laundering activities.

- Automated Risk Ratings: AI can dynamically adjust customer risk profiles based on transactional data.

- SAR Generation: AI can even draft automated Suspicious Activity Reports (SARs), saving hours of manual effort.

Credit Risk Management

Credit risk is one of the most significant challenges faced by financial services firms. Previously, these firms have relied on credit scoring models that generated limited data inputs and often missed out on providing granular insights to banks and financial services firms.

By leveraging AI, financial institutions can build advanced credit models that integrate historical financial data with present data (e.g., utility payments, real-time transactions, etc.) and notify both financial services firms and customers in case of any suspicious activity.

Cyber Risk and Information Security

Cyber threats are growing in volume, and they are becoming harder to tackle. From ransomware attacks to phishing mails, financial institutions are the top targets as they hold sensitive customer and business data. Implementing AI in risk management helps financial services firms to strengthen cybersecurity measures through real-time anomaly detection, intelligent automation, and predictive analytics.

How AI Protects Financial Services Firms Against Cyber Risk

- AI identifies abnormal user behavior across networks and endpoints, flagging zero-day vulnerabilities (refer to previously unknown flaws in AI systems that hackers exploit before the software vendor has a chance to patch them).

- Natural Language Processing can be used in detecting phishing emails and alert financial services firms to stay cautious.

- AI helps financial services developers write secure codes and prevent unauthorized access to sensitive data by building a strong firewall.

- As AI can effectively consolidate and analyze data from diverse sources, it empowers your security teams to be agile and respond quickly and effectively to unforeseen cyber threats.

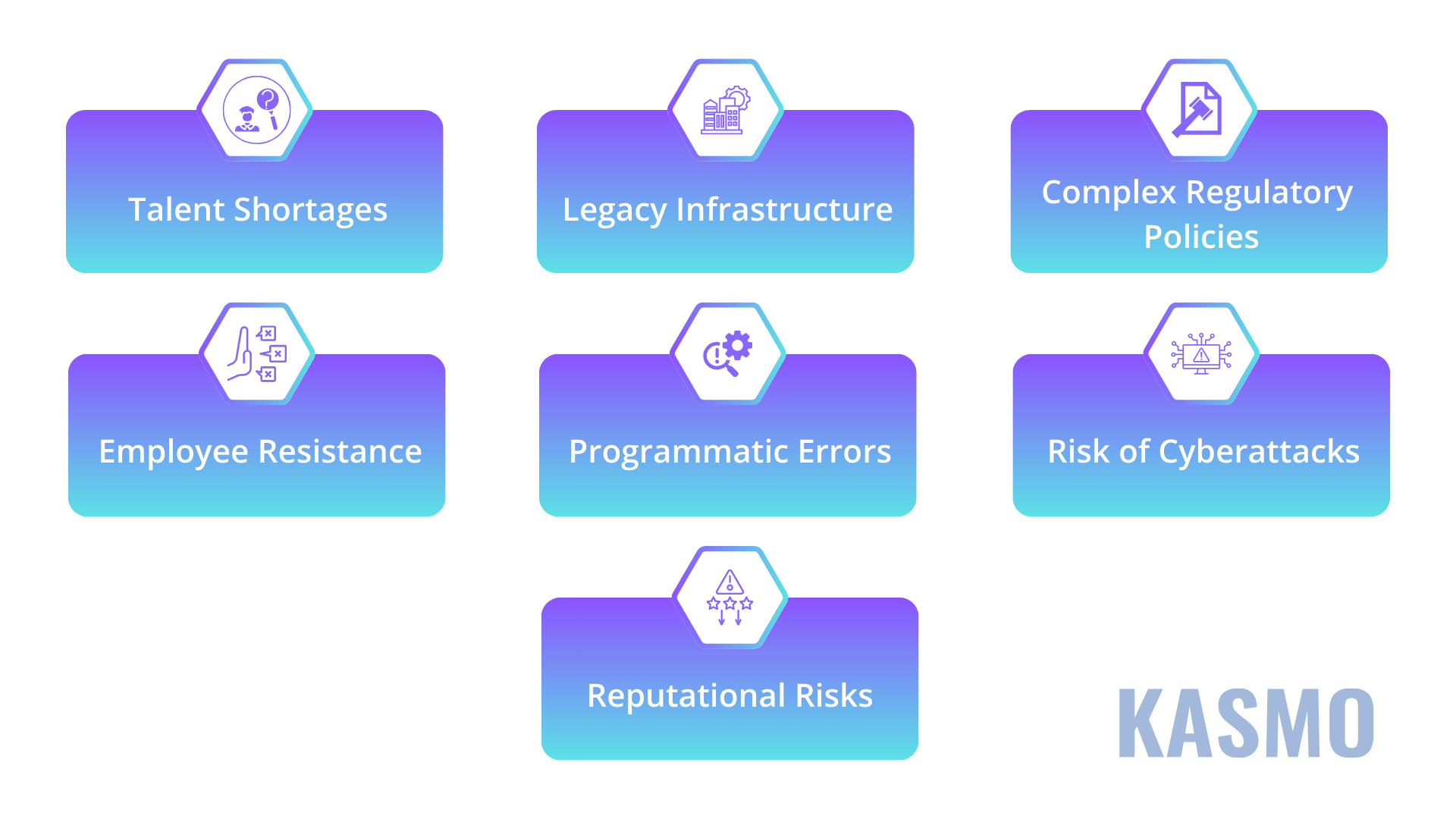

AI Adoption Challenges Faced by Financial Services Firms

AI/ML models are sometimes built without keeping the end-user in mind. Financial services firms face several challenges while adopting AI in financial risk management:

- Talent Shortages: Recruiting AI experts who also understand financial risk is a major hurdle.

- Legacy Infrastructure: Old systems lack the flexibility and data integration capabilities needed for AI deployment.

- Complex Regulatory Policies: Evolving global regulations around AI create legal challenges for businesses while adopting AI.

- Employee Resistance: Risk management professionals who are accustomed to manual methods may resist to new AI-powered tools.

- Programmatic Errors: Bugs in AI algorithms can cause significant financial and regulatory issues through incorrect calculations and assessments.

- Risk of Cyberattacks: Financial institutions are the prime targets for hackers seeking to exploit AI system vulnerabilities to steal sensitive data. Delay in adopting AI and AI-powered tools into operations can lead to increased cyberattacks.

- Reputational Risks: If the AI-powered tools or the integration of AI is not done properly, then financial services firms remain at a risk of losing out on their reputation and customer trust. Businesses need to be ethical and transparent while leveraging AI, to avoid any future discrepancies.

Why Choose Snowflake

Snowflake – the leading AI Data Cloud platform plays a pivotal role in enabling a secure, scalable deployment of AI models in risk management. With built-in governance, ML modeling tools, and enterprise-ready infrastructure, Snowflake helps financial services institutions use AI with ease and makes AI adoption an easy feat for both employees and customers.

Financial services firms can choose Snowflake for implementing AI in risk management because it provides:

Unified Platform for Data and AI/ML Models

Snowflake provides a single, scalable platform to access and analyze all types of financial data, eliminating data silos. This includes structured, semi-structured, and unstructured data. It integrates tools and infrastructure required to build, train, deploy, and manage AI/ML models without the need to move or copy data outside its platform.

Robust AI/ML Capabilities

- Snowpark ML: Enables data scientists and ML engineers to build features, train models using familiar Python syntax, and deploy them into production directly within Snowflake.

- Snowpark Model Registry: Simplifies the management and governance of ML models at scale.

- Snowpark Container Services: Allows for the deployment, management, and scaling of containerized AI/ML models, including fine-tuning open-source Large Language Models (LLMs) – using secure, Snowflake-managed architecture with GPUs.

- Snowflake Cortex: Offers fully managed, industry-leading AI models, LLMs, and vector search that can be leveraged via SQL or Python to analyze text data and build AI applications.

- Snowflake Arctic: Provides enterprise-grade, pre-built models with a dense-MoE (mixture of experts) architecture, offering top-tier results at lower development costs.

Enhanced Security and Governance

Snowflake is designed with built-in security features to protect sensitive financial data with strict controls, helping organizations meet compliance and risk requirements. By running AI/ML workloads within Snowflake, there’s no need to move governed data to external systems, enhancing security and simplifying governance.

Scalability and Performance

Snowflake’s elastic architecture allows financial institutions to scale compute resources up or down as needed to handle large datasets and demanding AI/ML workloads, thereby optimizing costs.

Enhanced Risk Management Activities

AI/ML models built and deployed on Snowflake can be used for a wide range of risk management activities, including:

- Assessing credit risk.

- Anti-money laundering (AML) programs.

- Fraud prevention systems.

- Identification of potential investment risk scenarios.

- Predictive analytics for identifying trends and potential risks.

- Analyzing unstructured data like customer interactions and news articles to uncover hidden risks.

AI can identify patterns and trends in data that human analysts might overlook, leading to more accurate risk assessments and faster detection of potential issues.

Integration and Collaboration

Snowflake facilitates seamless collaboration across different business lines by breaking down data silos. It also allows financial services to integrate internal datasets with external data from third-party sources through the Snowflake Marketplace, enriching data for more accurate insights.

Conclusion

The financial services industry is at the cusp of an AI-driven transformation. From regulatory compliance to fraud detection, credit analysis, and cyber defense. Leveraging AI in risk management can help financial services firms deliver operational efficiency and gain a strategic advantage. Financial services firms that are adopting AI for risk management will be able to make smarter decisions, reduce costs, and build a more resilient financial future.