Insurance underwriting plays an important role in managing risk and providing risk assessment solutions. It is a complex and data-driven process that traditionally depended on the expertise of manual underwriters to accurately assess a policy seeker’s risk. Today, the insurance industry is rapidly evolving, and insurance underwriters are looking for innovative risk assessment solutions for data analytics to improve their decision-making processes. AI based risk scoring is one such solution that improves data analysis in the insurance industry. By leveraging data analytics, artificial intelligence, and machine learning, these systems are revolutionizing the way underwriters evaluate risk.

Challenges in Traditional Insurance Underwriting:

1. Manual Process: Traditionally, manual underwriting was used for data collection, risk assessment, and evaluation for decisions. It is time-consuming and inefficient, resulting in delayed policy approvals, customer frustration, and increased operational costs.

2. Limited data availability: Manual underwriting did not have access to up-to-date information and depended on a narrow range of data sources, such as self-reported information from applicants and historical loss data. This limited data can lead to inaccurate risk assessments, underwriting bias, and missed opportunities for insurers.

3. Inaccurate risk assessment: Underwriters are responsible for manually evaluating a wide range of risk factors to determine the level of risk associated with insuring an individual. This includes (but is not limited to) applicant’s health, age, occupation, lifestyle, and previous insurance history. The manual process of risk assessment can be inconsistent and inaccurate.

4. Lack of automation and scalability: Traditional underwriting methods lacks automation and are not easily scalable to meet the growing demands of the insurance industry. This can hinder insurers’ ability to expand their reach and capitalize on new opportunities.

5. Historical methods: Traditionally, underwriters relied heavily on historical data, actuarial tables, and rule-based systems to make decisions. These methods can be time-consuming and may not adapt well to evolving risk factors.

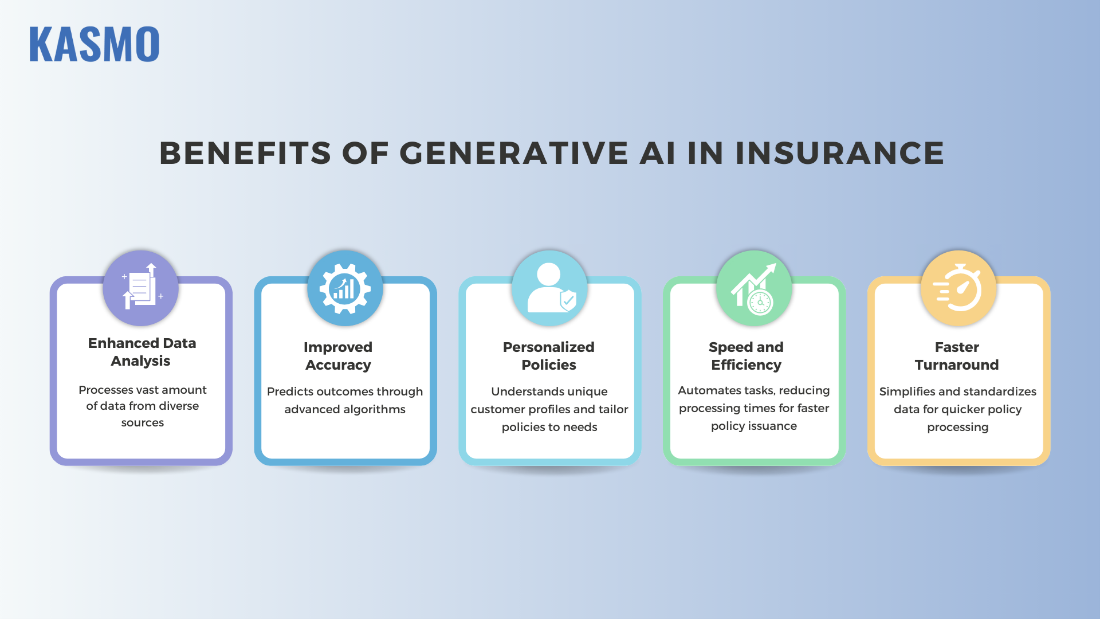

Advantages of AI based Risk scoring solutions

Automated underwriting is a key feature of risk scoring solutions. Routine tasks such as data entry, data collection, and analysis of data from various sources and real-time feeds can be automated, allowing underwriters to focus on more complex and strategic decision-making.

1. Predictive analytics for risk assessment:

Kasmo’s AI based risk scoring solutions utilize advanced predictive analytics models to assess risk factors, identify trends, and predict potential claims. By analyzing large datasets, underwriters gain insights into risk profiles that may not be immediately apparent through traditional methods. This can lead to more precise pricing and better risk selection.

2. Data Integration:

Risk scoring solutions combine data from various sources, including historical claims data, credit scores, medical records, property information, and more. This complete data integration ensures that underwriters have access to a broader range of information when evaluating risk.

3. Speed:

By automating the underwriting process, risk scoring solutions can significantly reduce the time it takes to issue policies. This not only benefits customers but also makes the charted property and causality underwriting more efficient in matching the growing demands in insurance industry.

Benefits of AI based Risk scoring solution for Insurers and Customers

Risk scoring solutions offer a host of benefits for both insurance companies and policyholders.

1. For Insurers:

Improved Risk Assessment:

Kasmo leverages AI Risk scoring solution to enhance data analytics in insurance industry using predictive models, which assist insurance underwriters in more accurate risk assessment, reducing the likelihood of under-pricing or over-pricing policies.

Cost Reduction:

Kasmo’s solution helps with automation and efficiency, leading to cost savings by reducing the time required to do repetitive tasks. This helps insurers process policies more quickly and with fewer resources.

Competitive Advantage:

Insurers adopting Kasmo’s risk scoring solutions gain a competitive edge by offering faster insurance policies, more accurate underwriting, and more attractive policy terms.

2. For Customers:

Faster Approvals:

Kasmo’s solution helps in automating data collection, integration of various sources and evaluation so that policyholders experience faster approval times. Making it more convenient to secure coverage when they need it.

Fair Pricing:

Our Risk scoring solution ensures that policyholders are charged premiums that accurately reflect their individual risk profiles .

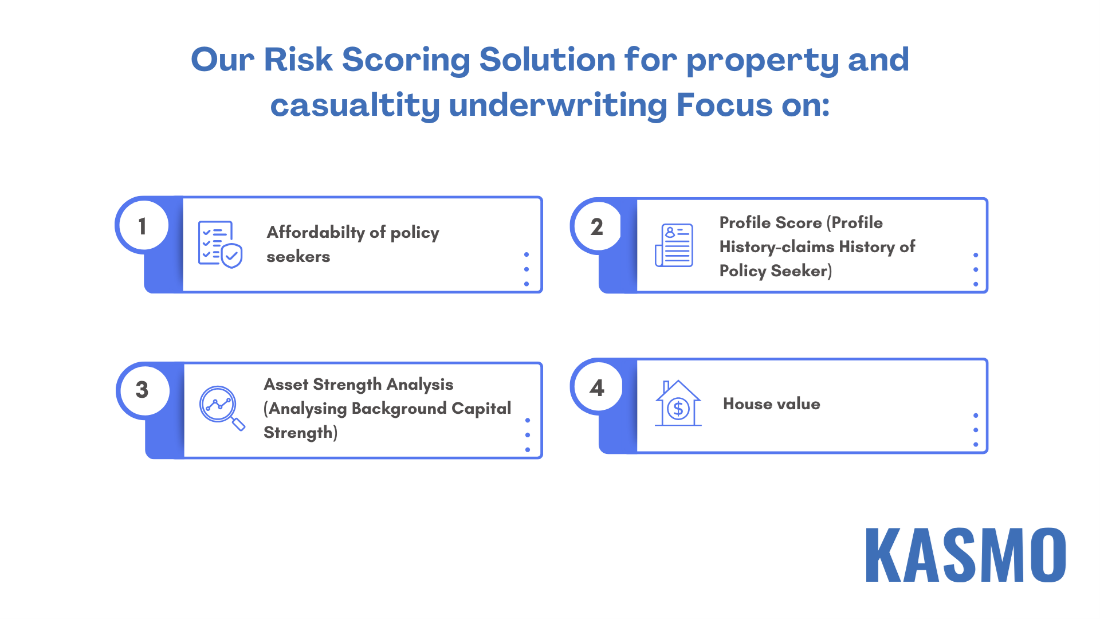

Kasmo’s Risk Assessment Solution for Property and Casuality Underwriting

Better risk assessment is required before the policy is issued to the customers. It is a key factor in reducing future losses for property and casuality insurers. Our solution integrates client financial data and other potential risks, which will help the insurance underwriters better assess the customer profile.

How Our Risk Scoring Model Works

Kasmo’s Risk scoring model analyzes multiple factors including the risk percentage (0–100%), asset or property’s age, weather graphs, customer financials graphs, and claims graphs. This helps underwriters in decision-making related to the risk involved in issuing policies.

Risk scoring solution is a game-changer in the insurance industry. They empower underwriters with the tools and insights needed to make more informed and consistent decisions.

Kasmo’s risk scoring solutions helps both insurers and policyholders in accurate, efficient and transparent insurance underwriting. It’s a transformative step toward ensuring that individuals and businesses are protected with policies that best match their unique risk profiles.